Home

Naira at lowest level in 43 years, now N305/dollar

The financial sector appears to have entered a heightened pressure, yesterday, as both the foreign exchange and stock market sustained major negative trends.

The Naira depreciated further to a 43-year low at N305 per dollar as scarcity of dollars intensified in the unofficial market.

From an average of N287 per dollar on Tuesday, the parallel market exchange rate rose to an average of N305 per dollar across the country.

Similarly, the new year stock market haemorrhage entered the eighth day yesterday, with a total N1.22 trillion losses to investors, giving a year-to-date decline of 12.36 per cent in market capitalisation. The market key index, the Nigerian Stock Exchange All Share Index, NSE ASI, declined year-to-date by same margin.

The stock exchange, which opened this year at market capitalisation of N9.851 trillion began a free fall till yesterday, closing at N8.63 trillion while the NSE ASI which opened the year at 28,642.25 points closed yesterday at 25,103.05 points.

The losses were heightened in the last 48 hours with a cumulative two-day loss of N430 billion following the escalated foreign exchange management crises which came with CBN’s announcement of its decision to cease sale of foreign exchange to BDCs on account of the precarious state the operators had forced the entire economy.

Since Monday when the Central Bank of Nigeria (CBN) stopped weekly dollar sales to Bureaux De Change (BDCs), the Naira has been depreciating against the dollar.

BDC sources who confirmed the development to Vanguard , however, said that the exchange rate situation is uncertain as the rate changes from time to time.

Investigation revealed that though the exchange rate touched N305 in major cities like Lagos, Abuja and Kano, it dropped slightly to between N295 and N300 per dollar in Lagos and Abuja at the close of business, while it closed at N305 in Kano.

Chief Executive Officer, H.J Trust BDC, Mr. Harrison Owoh, told Vanguard that the market is fluid.

“You cannot quote any rate for anybody now because the rate is changing every time.”

Financial analysts believe that the CBN’s state-of-the-economy address which came with the BDCs forex ban are having immediate negative effects on the economy, causing investors to withdraw from the Nigerian bourse to safer securities on the continent.

Justifying the ban, the CBN Governor, Mr Godwin Emefiele, had said: “This fall in oil prices also implies that the CBN’s monthly foreign exchange earnings has fallen from as high as US$3.2 billion to current levels of as low as US$1 billion.

“Yet, the demand for foreign exchange by mostly domestic importers has risen significantly. For example, the last we had oil prices at about US$50 per barrel for an extended period of time was in 2005. “At that time, our average import bill was N148.3 billion per month.

‘’In stark contrast, our average import bill for the first nine months of 2015 is N917.6 billion per month, even though oil prices are now less than US$35 per barrel.

“The net effect of these combined forces unfortunately is the depletion of our foreign exchange reserves.

‘’As of June 2014, the stock of Foreign Exchange Reserves stood at about US$37.3 billion but has declined to around US$28.0 billion as of today.

“With the current economic realities in the country, the NSE, with the aim of hitting N200 trillion market cap by 2019, may well be moving away from its target.

Meanwhile, the Speaker of the House of Representatives yesterday held a closed door meeting with the leadership of the Association of Bureaux De Change Operators of Nigeria (ABCON) over the continued depreciation of the naira. The meeting was still ongoing as at the time of going to press.

Also today the Director General of the Nigerian Stock Exchange, NSE, Mr. Oscar Onyema is expected to present the market outlook where investors’ sentiment is expected to be shaped.

VANGUARD

Home

“Political Hushpuppi” Ugochinyere is one of PDP’s aberrations, he is only cashing out – Wike’s Aide

Lere Olayinka, Senior Special Assistant on Public Communications and New Media to the Minister of Federal Capital Territory (FCT), Nyesom Wike, has described House of Representatives member from Ideato North and South Federal Constituency of Imo State, Imo Ugochinyere Ikeagwuonu, as a “political hushpuppi” who was produced by part of the aberrations in the People’s Democratic Party (PDP) that must be made to stop.

Olayinka, who told Ugochinyere to “stop going about masturbating about anything Wike,” admonished him to face the reason for which he was elected into the House of Representatives so that his constituents will stop seeing him as a failure and consistently passing votes of no confidence against him.

While featuring on Channels TV’s Politics Today on Friday, Ugochinyere, had said that the FCT Minister and other G5 Governors like Governor Seyi Makinde of Oyo State, former governors Samuel Ortom (Benue), Ifeanyi Ugwuanyi (Enugu) and Okezie Ikpeazu (Abia) were determined to destroy the Peoples Democratic Party (PDP).

However, in a statement in Abuja on Saturday, Olayinka said; “This is one of the things you get when people who joined the PDP today are awarded the ticket of the party tomorrow morning. If not for the aberration in the PDP that produced a character like Ugochinyere, someone who only joined the party in 2022 won’t be the one to lecture us about who is loyal to the party and who’s not.

“If PDP had functioned properly, would a ‘political hushpuppi’ like Ugochinyere have gotten the party’s ticket while still in another party? Even till today, as a PDP Rep member, Ugochinyere is still holding on to his Action Peoples Party (APP), using it to cash-out in Rivers State.

“Therefore, we on this side are not bothered because we understand why Ugochinyere must now mount the podium and accuse Wike of playing childish and kindergarten politics. He must satisfy those feeding him from the resources of Rivers State.”

While mocking Ugochinyere for always having an organization to speak for to carry out his political hustle, Olayinka said; “In saner climes, such character would have been arrested, tried and jailed for impersonation.

“When he got to the House of Representatives and there was no title under which his political hushpuppism would continue, he awarded to himself a non-existing title of ‘Spokesperson of Opposition Lawmakers Coalition in the 10th National Assembly,’ claiming to have been so appointed by the Coalition of United Political Parties (CUPP).

“But the questions are, is CUPP a political party with members in the House of Representatives? Where and when was CUPP registered? Apart from the positions of Minority Leader, Deputy Minority Leader, Minority Whip and Deputy Minority Whip, is there anything like spokesperson of opposition lawmakers in the National Assembly?

“Being a political hustler that he has always been, Ugochinyere, knew that he will be contravening the rules of the National Assembly by allocating to himself, a non-existing position, but he just must have a title to keep his hustle going, and indeed, it has been booming.

“Impersonating as spokesperson of opposition lawmakers in the House of Representatives, Ugochinyere has been cashing out in Rivers State in particular. If he is not using his former party, APP, to cash-out, he will be using his amorphous opposition lawmakers to chop from inside the Rivers.”

Foreign

Decimated Hezbollah says it is ready for cease-fire talks with Israel

Hezbollah said Tuesday it is now ready to engage in cease-fire talks with Israel, after suffering serious blows to its leadership and ranks in recent months.

The terror group in Lebanon made the announcement after firing more than 100 rockets at the Jewish state hours earlier.

Hezbollah’s deputy secretary general, Naim Qassem, publicly endorsed a truce with Israel, the first such time the terror group has proposed a cease-fire not conditioned on the war in Gaza.

“We support the political efforts led by [Lebanese Parliament Speaker Nabih] Berri under the banner of achieving a cease-fire,” Qassem said, according to a CNN translation.

“Once the cease-fire is firmly established and diplomacy can reach it, all other details will be discussed and decisions will be made collaboratively,” he added.

Qassem’s announcement came within hours of a massive barrage that sent more than 100 missiles soaring from Lebanon at Israel’s northern city of Haifa, the third-largest metropolis in the Jewish state.

Home

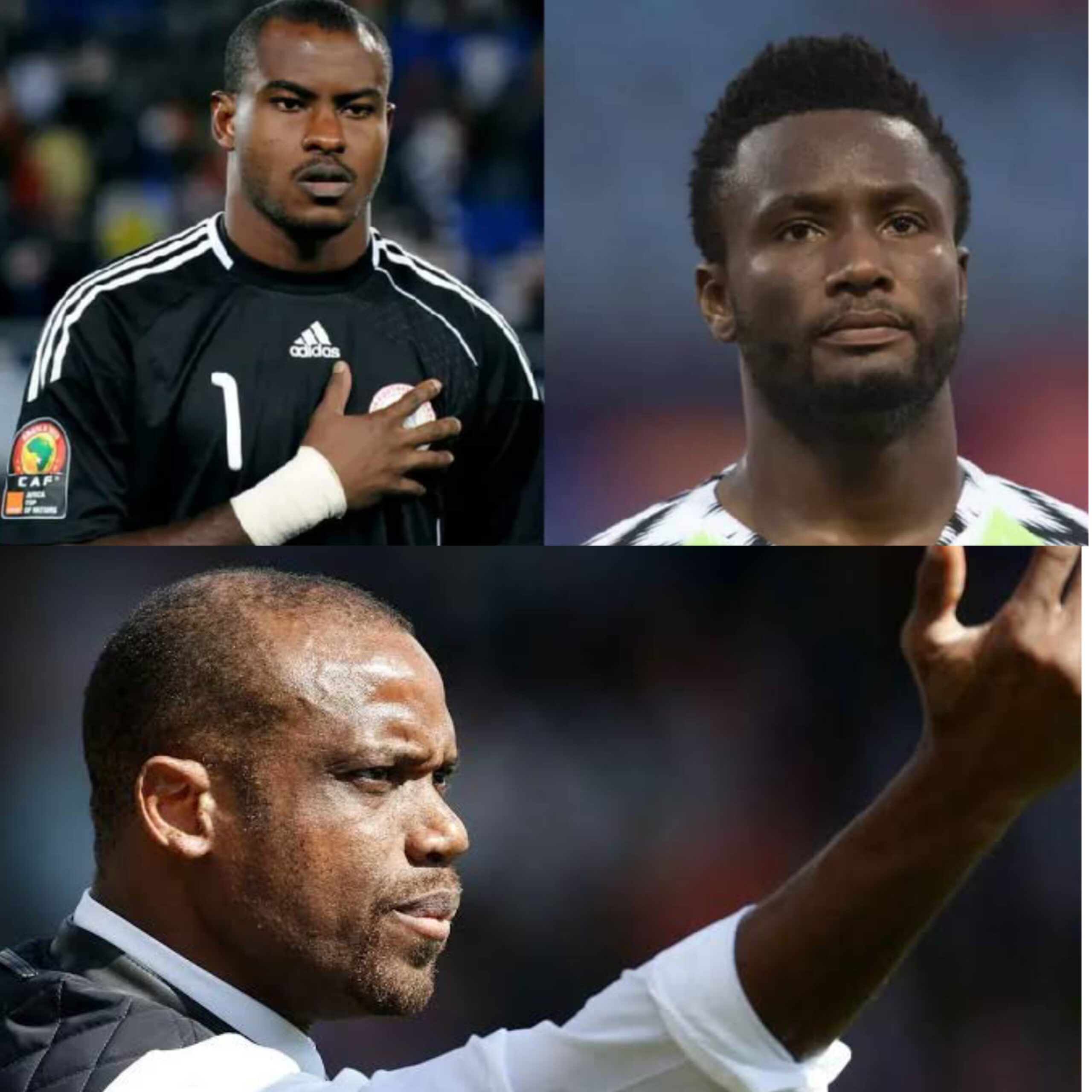

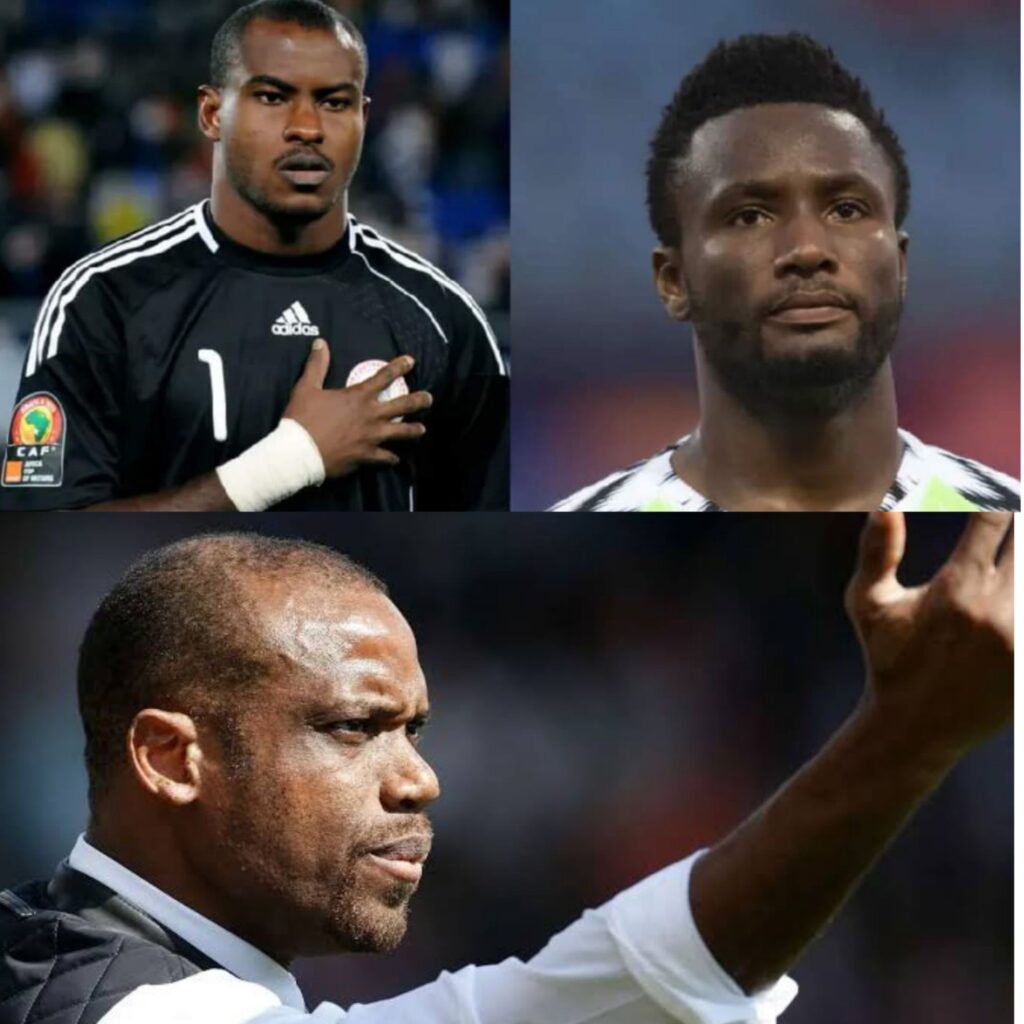

“Absolutely Clueless And Easily The Worst Manager I Played Under” — Mikel Obi Blasts Sunday Oliseh; Blames Him For Vincent Enyeama’s Early Retirement

He said’ “I remember the first day he came into the camp. Then we reported to the camp for International duties, then he came straight at me and Vincent Enyeama, the goalkeeper, who also was very powerful back then.”

“He came straight at us and Elderson Echiejile, and he said a few things. He said he heard there was a lot of player power with us.

“Then Enyeama was like, ‘What’s wrong with you? Where are you getting all of these from? We are a nice group, and you just come in, and the first thing is to attack us?

“He was like ‘I heard about you guys.’ And then Enyeama stood up and told him he couldn’t say that because we had been here for so many years. They started arguing, and literally, they were going to have a fight.

“He took Enyeama out of the team, and he came at us saying he was going to take us out of the team. He said he was going to take us out of the team; he said he was going to make sure we didn’t play anymore.”

“Enyeama could not take it, and despite my pleas, he left the camp angrily and never came back.”

“He (Oliseh) had absolutely no clue of how a manager is. He was a fantastic guy in his playing days, but as a coach, he was very terrible. He had no clue what he was doing.

“The players never understood anything he was doing, and he did not know what he was doing. He was just confused because he just came in and destroyed the team’s togetherness.

“His excuse when he got fired was that the people and FA did voodoo on him not to succeed. He was easily the worst manager I played under.

“He was so bitter with everybody, jealous with everybody, and had no respect for speaking to anybody, whether the physio or anybody,” he added.

-

News1 year ago

News1 year agoHardship: We Plan To Establish A National Commodity Board To Crash Food Prices – VP Shettima

-

News7 years ago

Blog Reader; Samson Osagiede Celebrates Fiancè Benedicta Daniels’s Birthday With Sweet Words

-

Home9 years ago

News Channel claims Donald Trump is an orphan from Pakistan,share alleged childhood photo

-

Home9 years ago

Another $175m Found in Patience Jonathan’s wife’s firm’s Bank Account

-

Home9 years ago

Oil Spillage: House of Reps Member Shares Photos of the Water her Constituents Drink .

-

Home9 years ago

Zara Buhari & Ahmed Indimi’s Wedding Access Card

-

News7 years ago

The Best Video You’ve Seen Today?

-

Sport7 years ago

Sport7 years agoModric, Marta Wins 2018 FIFA Best Player Of The Year Awards ⚽️