News

How FIRS Plans To Realise Its Revenue Target -Fowler

The Federal Inland Revenue Service (FIRS) says it plans to realize its revenue target for the year through recoveries from defaulting millionaire taxpayers, values added (VAT) and compliance enforcement activities.

The Chairman of FIRS, Tunde Fowler, said in January that the agency’s revenue collection target for 2019 was about N8 trillion.

Mr Fowler told the House of Representatives joint committees on Finance, Appropriations, Aids, Loans and Debt Management Legislative Budget and Research and National Planning and Economic Development that he hopes about N750bn would be realized from about 55,000 defaulting taxpayers during the year.

Mr Fowler, who spoke on the 2019/2021 Medium Term Expenditure Framework (MTEF) and Fiscal Strategy Paper (FSP), said using banking information to bring non-compliant taxpayers with N1 billion and above turnover to comply about N23.25 billion has been recovered so far.

He also restated that 85% of VAT collected goes to State Governments. He said the exercise has been extended to cover those with turnover of N100 million and above.

“To date, about 500 of the tax defaulters have come forward and have paid about N24 billion. We believe we should be able to go through the 55,000 before the middle of this year.

“In terms of estimates we should be able to be able to generate from this exercise alone about N750 billion.”

Besides, Mr Fowler said the FIRS also expects that the increase in Value Added Tax (VAT) collection between 2015 and 2018 will continue during the year.

He said FIRS is already broadening its VAT collection scope with the adoption of States Accountants Generals (SAG) collection platform, VAT Auto-Collect, integration of the GIFMIS platform with Ministries, Departments and Agencies, (MDAs) and through e-Service payment options.

Out of about N5.3 trillion, a large percentage of the revenue is shared between states and local governments.’ In VAT, there has been a growth of over 44 per cent between 2015 and 2018 at the current rate of 5 percent.

“When you look at Africa as a continent, Nigeria still has the lowest VAT rate. When we look at the items that do not attract VAT, they include basic food items, medicals, and education.

Insisting VAT is not for the poor, Mr Fowler said if one is able to go to a restaurant to eat and drink the same thing one can buy in the open market, then one can pay VAT.

“So, VAT basically is a consumption tax, and those who choose not to go to the open market to buy their food and cook at home are subject to VAT. So, VAT is not a hardship on the low income earners.

“For those who have the ability and the desire to take the choice of going to areas where they have to pay VAT, then they should be allowed to pay VAT,” he added. He said revenue collection by FIRS increased by about 32 per cent from N4.02 trillion in 2017 to N5.3 trillion in 2018.

The FIRS Chairman told the committee that through enforcement activities in respect of defaulting taxpayers from various tax offices, tax audit and investigation assessments, the agency recovered about N28. 51 billion and $77. 83 million.

Also, the FIRS is partnering with the Economic and Financial Crimes Commission (EFCC) and Joint Tax Force (JTF) since 2018 to enhance the fight against tax related economic fraud. As at December 2018, he said about N6. 94 billion and $278,430 had been recovered by the JTF as part of initiatives to boost revenue generation.

To deepen tax revenue collection and expand the nation’s tax net as well as increase the revenue base, Mr Fowler said the FIRS also initiated income tax on property owners in Abuja and Lagos.

He said the initiative, which was initially targeted at property owners in Abuja and Lagos, has so far yielded N4.3 billion, and is being extended to other locations like Oyo and Kaduna states.

“It is important to note that this is not a property tax, but rather the use of the provisions of the law to bring into the tax net companies that own properties but failed to file necessary tax returns and pay appropriate taxes due,” Mr Fowler said.

On tax audit exercise of the Service, the FIRS boss said this will cover both the National Tax Audit (NTA) and the Pioneer Audit (PA). The NTA exercise contributed the sum of N212.79 billion to tax collection in 2018.

News

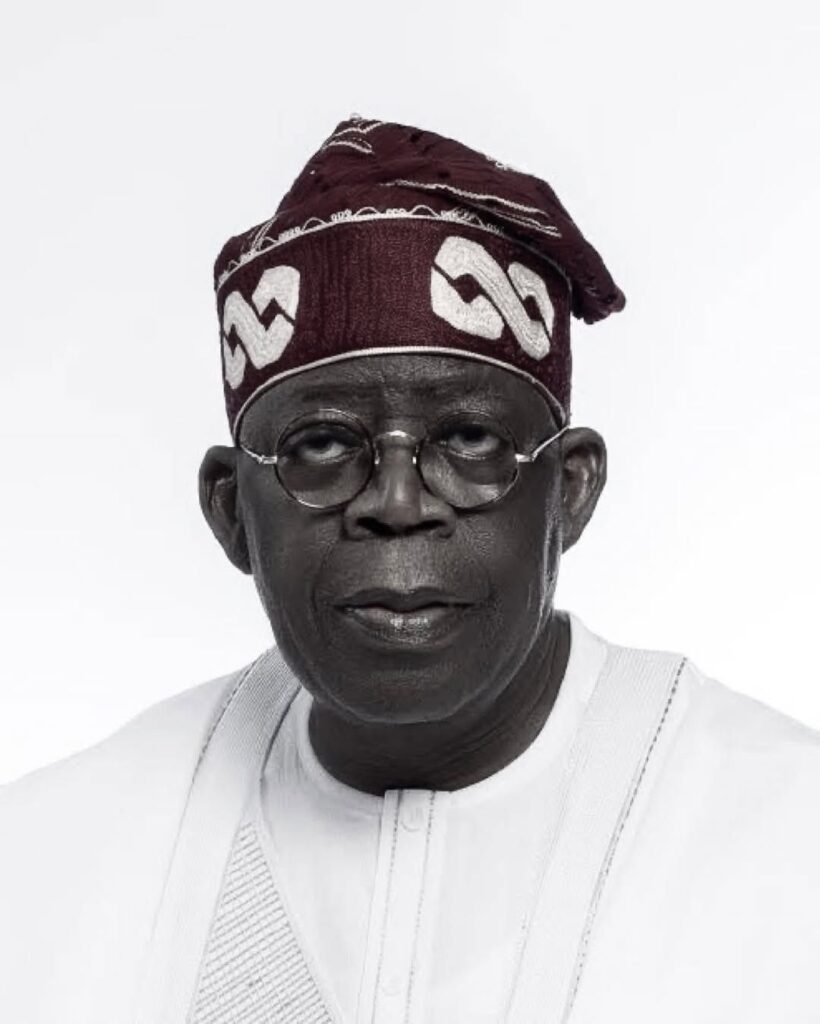

‘Give Them Their Money Directly’ — Tinubu Warns Governors Over LG Allocations

President Bola Ahmed Tinubu has issued a stern warning to state governors over the handling of Local Government (LG) allocations, insisting that funds meant for LGs must be paid directly to them in line with the Supreme Court judgment.

Speaking on Friday at the 15th APC National Executive Committee (NEC) meeting in Abuja, Tinubu stressed that the apex court has once again made its position clear, leaving no room for ambiguity. According to him, compliance is no longer optional, as the judgment is binding on all tiers of government.

“The Supreme Court has capped it for you again, saying, ‘give them their money directly’. If you wait for my Executive Order, because I have the knife, I have the yam, I will cut it,” the President said, adding that he has chosen to be patient and respectful with governors.

However, Tinubu warned that continued delay or refusal to implement the ruling would attract consequences, noting that enforcement could begin through FAAC disbursements if necessary.

Emphasizing the rule of law, the President said the ultimate authority remains the Supreme Court and its judgment must be obeyed without excuses.

“We have to comply. We have to respect the judgment,” he concluded.

News

Accord Party Welcomes Adeleke for 2026 Governorship Bid

The Accord Party in Osun State has indicated that Governor Ademola Adeleke would be granted a waiver if he decides to contest the 2026 governorship election under its platform.

Victor Akande, Chairman of Accord Party in Osun, told The PUNCH on Sunday that Adeleke or his aides have not formally approached the party, describing speculation about a potential defection as “mere rumours.”

Accord Party has emerged as a possible platform for Adeleke’s re-election amid internal tensions in his current party, the People’s Democratic Party (PDP).

Akande said the party already has two aspirants for its ticket in the August 8, 2026 election but would welcome Adeleke if he chooses to join.

“The issue of Governor Adeleke is still a rumour. I have not met with anyone from the government about this. Accord Party is not the only option being speculated for his defection, but if he comes, we will receive him wholeheartedly,” Akande stated.

He added, “Our doors are always open. People are free to join or leave at any time. If Adeleke comes, he will receive a waiver to contest just like any other aspirant. Currently, two individuals have shown interest in running under our platform, though they have not made financial commitments yet.”

Foreign

Goodluck Jonathan Reportedly Stranded in Guinea-Bissau After Sudden Military Takeover

Former Nigerian President Goodluck Jonathan is reportedly stranded in Guinea-Bissau following the military’s announcement of a takeover on Tuesday.

Jonathan, who travelled to the country as part of an international election observation mission, was expected to oversee the release of official results before the unexpected shift in power disrupted all movement. Sources say he and other foreign observers are currently unable to leave as security restrictions tighten across the capital.

The situation has sparked concern among regional stakeholders, with diplomatic channels said to be monitoring developments closely. So far, neither Jonathan nor Nigerian authorities have issued an official statement on his safety or plans to return.

The unfolding political tension in Guinea-Bissau continues to draw global attention, especially as the fate of the election results remains unclear.

-

News2 years ago

News2 years agoHardship: We Plan To Establish A National Commodity Board To Crash Food Prices – VP Shettima

-

News8 years ago

Blog Reader; Samson Osagiede Celebrates Fiancè Benedicta Daniels’s Birthday With Sweet Words

-

Home9 years ago

News Channel claims Donald Trump is an orphan from Pakistan,share alleged childhood photo

-

Home9 years ago

Another $175m Found in Patience Jonathan’s wife’s firm’s Bank Account

-

Home9 years ago

Oil Spillage: House of Reps Member Shares Photos of the Water her Constituents Drink .

-

Home9 years ago

Zara Buhari & Ahmed Indimi’s Wedding Access Card

-

Sport7 years ago

Sport7 years agoModric, Marta Wins 2018 FIFA Best Player Of The Year Awards ⚽️

-

News8 years ago

The Best Video You’ve Seen Today?